Inhibrx Inc (INBX) (~$1.8B market cap) is a clinical stage biotech that announced the sale of their most advanced therapy, INBRX-101 (a treatment for patients with alpha-1 antitrypsin deficiency or "AATD"), in January to Sanofi (SNY) for $30/share in cash, plus 92% ownership in the remaining development pipeline via a taxable spin of NewCo Inhibrx Biosciences (SNY to retain the other 8%) and a $5/share CVR that pays out if INBRX-101 receives final FDA approval prior to 6/30/2027. INBX shares trade for $34.20 today -- all approvals have been received and the merger will close 5/30/24.

The advantage of this structure is Inhibrx won't pay corporate taxes on the sale of INBRX-101, but shareholders will still pay taxes based on their tax basis, avoiding the double tax if Inhibrx had simply sold INBRX-101 and continued on in the same corporate structure. We've seen similar deals with Pfizer/Biohaven (they even mention in the proxy wanting to do a "Biohaven-like structure") and a little further back, JNJ/Actelion/Idorsia, where both SpinCos performed well initially post deal completion.

My thinking around this transaction is pretty straight forward, because the $30/share makes up a vast majority of the consideration here, the merger/stub securities are likely undervalued, although it is hard to size this up enough to create a meaningful position (INBX isn't marginable at my broker for some reason). For the SOTP, I'm going to lean on the proxy statement as I don't have an informed view on the science other than this team already developed one valuable asset in INBRX-101.

The CVR is fairly simple, there's only one milestone, that's FDA approval of INBRX-101 for AATD:

At or prior to the Effective Time, pursuant to the Merger Agreement, Parent will enter into a Contingent Value Rights Agreement between Parent and Continental Stock Transfer & Trust Company (the “Rights Agent”), in substantially the form attached to the Merger Agreement (the “CVR Agreement”). Each CVR will represent the right to receive a contingent payment of $5.00 in cash, without interest, payable to the Rights Agent for the benefit of the holders of CVRs, if the following milestone is achieved:•The final approval by the U.S. Food and Drug Administration (“FDA”), on or prior to June 30, 2027, of the new drug application or supplemental new drug application filed with the FDA pursuant to Section 351 of the Public Health Service Act and 21 CFR §§ 600 et seq. (for clarity, including accelerated approval) that is necessary for the commercial marketing and sale of the Company’s precisely engineered recombinant human AAT-Fc fusion protein, also known as INBRX-101 in the United States of America for the treatment of patients with AATD and clinical evidence of emphysema following the clinical trial with identifier INBRX101-01-201, entitled “A Phase 2, Double-Blind, Randomized, Active-Control, Parallel Group Study to Assess the Pharmacokinetics, Pharmacodynamics, Immunogenicity, and Safety of INBRX-101 Compared to Plasma Derived Alpha-1 Proteinase Inhibitor (A1PI) Augmentation Therapy in Adults with Alpha-1 Antitrypsin Deficiency Emphysema,” regardless of any obligation to conduct any post-marketing or confirmatory study (which we refer to as the “Milestone”).

For the CVR valuation, Centerview (INBX's advisor) put the NPV at $2.05/share using a 60% success rate, which the company provided (management took down the success rate from 90%, citing a less advantageous regulatory environment and potential success of similar products):

Contingent Value Right AnalysisFor analytical purposes, assuming a 60% probability CVR holders receive an aggregate payment of $5.00 per CVR upon the achievement of the Milestone based on the probability of success as estimated by Company management in, and the estimated timing of achievement of the Milestone under the CVR Agreement implied by, the Management Forecasts, as described under the section entitled, “The Transactions — Certain Financial Projections” and further assuming a discount rate of 13.5%, the midpoint of a range of discount rates from 12.5% to 14.5%, based on Centerview’s analysis of the Company’s weighted average cost of capital, Centerview calculated an illustrative net present value for one (1) CVR of $2.05.

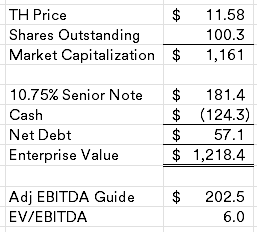

Inhibrx Biosciences (SpinCo) is a little more complicated, SNY is going to seed the company with $200MM of cash, which is expected to get them about a year of cash runway. The spin ratio is 0.25 shares of SpinCo for each share of INBX. The spinoff will have INBX's remaining development assets, which includes two oncology therapies currently in clinical studies with data readouts within the next 12 months:

•INBRX-106 is a hexavalent product candidate agonist of OX40. OX40 is a co-stimulatory receptor expressed on immune cells that is enriched in the tumor microenvironment. OX40 ligand is a trimeric protein that activates OX40 signaling through clustering.•INBRX-109 is a precision-engineered, tetravalent death receptor 5 (DR5) agonist antibody designed to exploit the tumor-biased cell death induced by DR5 activation.

INBRX-109 (which has both fast track and orphan designations) is farther along, it is currently in a registration enabling Phase 2 trial for the treatment of chondrosarcoma (an aggressive type of bone cancer where most patients do not respond well to current therapies) with data expected in the first half of 2025. INBRX-106 is in a Phase 1/2 study testing it in combination with Keytruda, initial data is expected towards the end of 2024. Again, leaning on Centerview's analysis:

SpinCo Discounted Cash Flow AnalysisCenterview performed a discounted cash flow analysis of SpinCo based on the Management Forecasts. A discounted cash flow analysis is a traditional valuation methodology used to derive a valuation of an asset or set of assets by calculating the “present value” of estimated future cash flows of the asset or set of assets. “Present value” refers to the current value of future cash flows or amounts and is obtained by discounting those future cash flows or amounts by a discount rate that takes into account macroeconomic assumptions and estimates of risk, the opportunity cost of capital, expected returns and other appropriate factors.For purposes of the analysis of the net present value of the future cash flows of SpinCo, Centerview calculated a range of equity values for 0.25 of a share of SpinCo common stock by (a) discounting to present value as of June 30, 2024 using discount rates ranging from 14.0% to 16.0% (reflecting analysis of SpinCo’s expected weighted average cost of capital) and using a mid-year convention: (i) the forecasted risk-adjusted, after-tax unlevered free cash flows of SpinCo over the period beginning on June 30, 2024 and ending on December 31, 2043, utilized by Centerview based on the Management Forecasts, (ii) an implied terminal value of SpinCo, calculated by Centerview by assuming that unlevered free cash flows would decline in perpetuity after December 31, 2043 at a rate of free cash flow decline of 60% year over year (with the exception of platform cash flows for which a 0% perpetuity growth rate was assumed), and (iii) tax savings from usage of SpinCo’s federal net operating losses from SpinCo’s estimated future losses, as set forth in the Management Forecasts, and (b) adding to the foregoing results SpinCo’s estimated net cash of $200 million, assuming SpinCo is capitalized with $200 million in cash and no debt, as of June 30, 2024, and the net present value of the estimated costs of an assumed $150 million equity raise in 2025 and $300 million equity raise in each of 2026 and 2027, as set forth in the Internal Data. Centerview divided the result of the foregoing calculations by the number of fully diluted outstanding shares of estimated SpinCo common stock (determined using the treasury stock method and taking into account the dilutive impact of warrants on the then-existing terms and 8% of shares of SpinCo common stock to be retained by the Company, and assuming no exercise of Company options receiving SpinCo common stock, as instructed by Company management) as of January 18, 2024, based on the Internal Data, resulting in a range of implied equity values per 0.25 of a share of SpinCo common stock of $5.85 to $7.95 rounded to the nearest $0.05.

Just based on cash, the NewCo would be worth $3.40/share of INBX at the outset, although that's a bit faulty logic as the cash is already spoken for in the projected cash burn. But again, pattern recognition here tells me that this situation has a decent shot of working out well in the near term, $30.00 + $2.05 + $5.85 = ~$38/share versus the current $34.20/share. If you back out the $30/share in cash, the stub is a potential bargain heading into closing at month end.

Disclosure: I own shares of INBX